PDF(2499 KB)

PDF(2499 KB)

PDF(2499 KB)

PDF(2499 KB)

PDF(2499 KB)

PDF(2499 KB)

“双碳”目标下我国碳排放配额分配机制及其优化策略

The allocation mechanism and optimization strategies of carbon emission allowance in China under Carbon Peak and Neutrality Goals

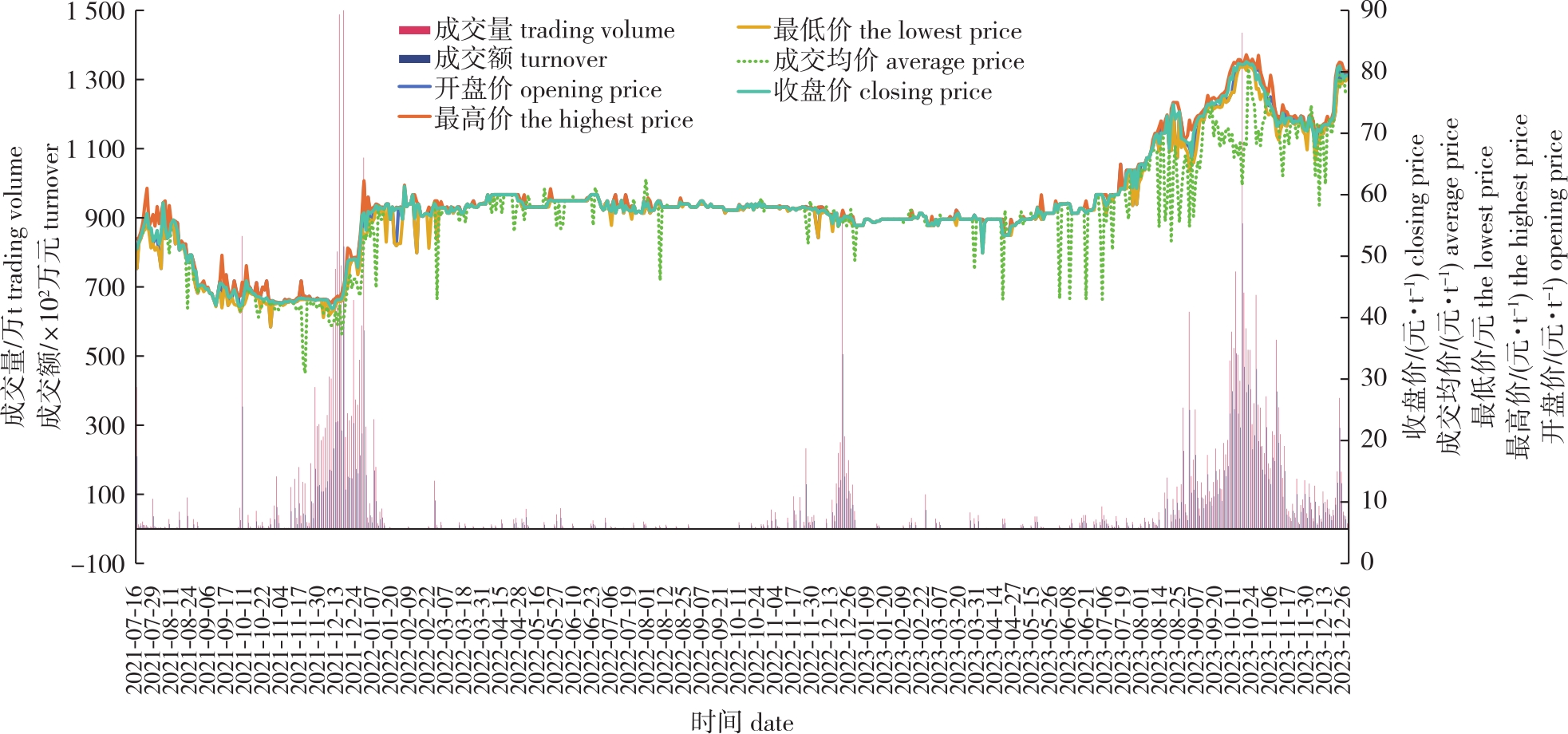

【目的】建设全国碳市场是利用市场机制控制和减少温室气体排放、推进绿色低碳发展的一项重大制度创新,也是推动实现碳达峰目标与碳中和愿景的重要政策工具,科学、公平、合理地分配碳排放配额是碳交易开展过程的核心问题。基于碳排放配额分配现状,分析碳交易体系中碳排放配额分配机制及成效,并提出优化策略以助力我国碳交易市场发展。【方法】以“现状—问题—对策”为研究路径,采用文献综述、案例归纳分析、比较分析等方法对国际主要碳市场的配额分配模式进行分析,归纳梳理我国碳排放配额分配机制的现状及主要问题,并对今后的机制和策略优化提出相关建议。【结果】①基于国际视角总结主要市场在碳排放配额分配方面的实践经验,在制定碳市场适当的减排目标和灵活的调整机制、建立充足的参与信心和稳定的价格机制、健全完善的市场机制和配套的法律制度基础上,有序落实免费与有偿相结合的碳排放配额分配方式,为我国碳排放配额分配提供启示和参考。②基于国内视角总结我国碳排放配额分配方面的现状,我国碳排放配额分配取得一定成效,配额总量逐步分层优化,覆盖行业范围逐步扩大,分配原则多元化发展以及分配方式由免费向有偿逐步过渡;但仍存在顶层设计有待完善、分配方式较为单一、市场活力尚未激发和配套措施有待健全等诸多亟需解决的问题。【结论】立足我国碳排放配额分配现状及未来发展趋势,加强分配的统筹规划和顶层设计,推动分配的渐进式发展,建立科学合理的交易生态,健全法律法规、分配方法、市场机制等配套措施,推动碳排放配额分配的市场化赋能和策略优化,可为我国碳交易市场的发展、有效实现碳减排目标提供解决路径和模式参考。

【Objective】The establishment of the national carbon market represents a significant institutional innovation for reducing greenhouse gas emissions through market mechanisms and promoting green and low-carbon development. It also serves as a crucial policy instrument for advancing the achievement of the carbon-peak goal and the carbon-neutrality vision. The scientific, fair, and reasonable allocation of carbon emission quotas lies at the core of the carbon trading process. This study analyzed the allocation of carbon emission quotas within the carbon trading system based on the current situation and proposed optimization strategies to offer references for the development of China’s carbon trading market.【Method】Adopting the research path of “status quo-problems-countermeasures”, this study employed methods such as literature review, case summarization, and comparative analysis. It analyzed the quota allocation models of major international carbon markets, summarized the current status and main problems of China’s carbon emission quota allocation mechanism, and puts forward relevant suggestions for future mechanism and strategy optimization.【Result】(1) From an international perspective, the practical experiences of major markets in carbon emission quota allocation were summarized. For instance, setting appropriate emission-reduction targets and flexible adjustment mechanisms in the carbon market, building sufficient confidence in participation and a stable price mechanism, as well as establishing a sound and perfect market mechanism and supporting legal system, provided valuable insights and references for the orderly implementation of a combination of free and paid carbon emission quota allocation methods.(2) From a domestic perspective, the current situation of China’s carbon emission quota allocation was summarized. With the development of China’s carbon trading market, certain achievements have been made in carbon emission quota allocation, including the gradual optimization of the tier-by-tier total quota amount, the progressive expansion of the covered industry scope, the diversification of allocation principles, and the gradual transition of the allocation mode from free to paid. Nevertheless, there are still numerous issues to be addressed, such as the need to improve the top-level design, the relative simplicity of the allocation method, the lack of stimulation of market vitality, and the necessity to enhance supporting measures.【Conclusion】Based on the current situation and future development trends of China’s carbon emission quota allocation, it is essential to strengthen the overall planning and top-level design of allocation, promote the progressive development of allocation, establish a scientific and reasonable trading ecosystem, improve laws, regulations, allocation methods, market mechanisms, and other supporting measures, and promote the market-based empowerment and optimization of the carbon emission quota allocation strategy. This will offer solution paths and model references for the development of China’s carbon trading market and the effective realization of carbon-emission-reduction targets.

碳排放权交易 / 碳排放配额分配 / 发展模式 / 优化策略

carbon emissions trading / carbon emission allowance allocation / development model / optimization strategy

| [1] |

文亚, 张弢. 中国与欧盟碳市场建设理念与实践比较研究:历史沿革、差异分析与决策建议[J]. 中国软科学, 2023(5):12-22.

|

| [2] |

李汪繁, 吴何来. “双碳”目标下我国碳市场发展分析及建议[J]. 南方能源建设, 2022, 9(4):118-126.

|

| [3] |

邹晓明, 王国兵, 葛之葳, 等. 林业碳汇提升的主要原理和途径[J]. 南京林业大学学报(自然科学版), 2022, 46(6):167-176.

|

| [4] |

中国证券监督管理委员会. 碳金融产品:JR/T 0244—2022[S]. 北京: 中国证券监督管理委员会,2022-04-12.

CSRC. Carbon finanical products:JR/T 0244—2022[S]. Beijing: CSRC, 2022-04-12.

|

| [5] |

|

| [6] |

|

| [7] |

|

| [8] |

|

| [9] |

|

| [10] |

|

| [11] |

王文举, 陈真玲. 中国省级区域初始碳配额分配方案研究:基于责任与目标、公平与效率的视角[J]. 管理世界, 2019, 35(3):81-98.

|

| [12] |

方恺, 张琦峰, 杜立民. 初始排放权分配对各省区碳交易策略及其减排成本的影响分析[J]. 环境科学学报, 2021, 41(2):696-709.

|

| [13] |

吴军, 李曼, 徐广姝, 等. 碳排放总量控制下行业间碳配额分配的博弈机制研究[J]. 北京化工大学学报(自然科学版), 2020, 47(6):115-120.

|

| [14] |

张益纲, 朴英爱. 世界主要碳排放交易体系的配额分配机制研究[J]. 环境保护, 2015, 43(10):55-59.

|

| [15] |

宣晓伟, 张浩. 碳排放权配额分配的国际经验及启示[J]. 中国人口·资源与环境, 2013, 23(12):10-15.

|

| [16] |

段茂盛. 碳市场配额分配机制的国内外实践及优化调整的建议[J]. 中国电力企业管理, 2024(7):26-28.

|

| [17] |

王科, 吕晨. 中国碳市场建设成效与展望(2024)[J]. 北京理工大学学报(社会科学版), 2024, 26(2):16-27.

|

| [18] |

|

| [19] |

|

| [20] |

|

| [21] |

嵇欣. 国外碳排放交易体系的政策设计对我国的启示[J]. 上海经济研究, 2014, 26(2):92-101.

|

| [22] |

蒋金星. 欧盟碳市场有效性评价及改进的经验借鉴[J]. 山东师范大学学报(社会科学版), 2023, 68(4):115-123.

|

| [23] |

邢佰英. 美国碳交易经验及启示:基于加州总量控制与交易体系[J]. 宏观经济管理, 2012(9):84-86.

|

| [24] |

吕建中. 以碳排放权交易市场机制助推绿色低碳转型[J]. 世界石油工业, 2021, 28(4):1-6.

|

| [25] |

郑鹏程, 张妍钰. “双碳” 目标实现的市场化路径及其制度完善[J]. 湖南大学学报(社会科学版), 2022, 36(4):107-112.

|

| [26] |

齐绍洲, 程师瀚. 中国碳市场建设的经验、成效、挑战与政策思考[J]. 国际经济评论, 2024(3):108-128.

|

| [27] |

熊灵, 齐绍洲, 沈波. 中国碳交易试点配额分配的机制特征、设计问题与改进对策[J]. 武汉大学学报(哲学社会科学版), 2016, 69(3):56-64.

|

| [28] |

田晓丽, 侯忠男. 浅议我国碳排放权初始配额分配机制[J]. 时代金融, 2022(6):76-78.

|

| [29] |

孙振清, 张喃, 贾旭, 等. 中国区域碳排放权配额分配机制研究[J]. 环境保护, 2014, 42(1):44-46.

|

| [30] |

刘粮, 傅奕蕾, 宋阳, 等. 国际经验推动我国碳金融市场成熟度建设的发展建议[J]. 西南金融, 2024(1):43-53.

|

| [31] |

魏庆坡. 碳交易与碳税兼容性分析:兼论中国减排路径选择[J]. 中国人口·资源与环境, 2015, 25(5):35-43.

|

| [32] |

潘晓滨, 史学瀛. 碳排放交易中配额无偿分配的制度构建[J]. 天津大学学报(社会科学版), 2016, 18(4):338-343.

|

| [33] |

张潇, 邵鑫潇, 蒋惠琴. 行业碳排放权的初始配额分配:文献综述[J]. 资源开发与市场, 2018, 34(11):1520-1525.

|

| [34] |

魏咏梅, 王心雨, 丁毅宏, 等. 碳达峰目标下考虑碳转移的中国电力行业省域碳配额分配研究[J]. 干旱区资源与环境, 2023, 37(7):19-26.

|

| [35] |

关海玲, 张华. 基于碳排放总量约束的我国产业部门碳配额分配研究[J]. 经济问题, 2024(3):76-84.

|

| [36] |

秦涛, 郭春艳, 任立久. 我国碳资产证券化的发展模式、制约因素与突破方向[J]. 经济问题, 2024(5):67-75.

|

| [37] |

彭红军; 徐笑; 俞小平. 林业碳汇产品价值实现路径综述[J]. 南京林业大学学报(自然科学版), 2022, 46(6):177-186.

|

| [38] |

尚文芳, 张冰倩, 张智勇. 考虑有偿配额和碳交易的供应链碳减排决策研究[J]. 管理现代化, 2022, 42(6):1-7.

|

| [39] |

齐绍洲, 徐珍珍, 谭秀杰, 等. 中国碳市场产能过剩行业的碳排放配额如何分配是有效的?[J]. 中国人口·资源与环境, 2021, 31(9):73-85.

|

| [40] |

杨姗姗, 郭豪, 杨秀, 等. “双碳”目标下建立碳排放总量控制制度的思考与展望[J]. 气候变化研究进展, 2023, 19(2):191-202.

|

/

| 〈 |

|

〉 |