PDF(1557 KB)

PDF(1557 KB)

基于CEV期权定价模型的林业碳汇项目价值评估分析

张胜良, 敖海燕, 彭红军, 穆亚丽

南京林业大学学报(自然科学版) ›› 2025, Vol. 49 ›› Issue (5) : 242-248.

PDF(1557 KB)

PDF(1557 KB)

PDF(1557 KB)

PDF(1557 KB)

基于CEV期权定价模型的林业碳汇项目价值评估分析

Value evaluation analysis of forestry carbon sequestration project based on CEV option pricing model

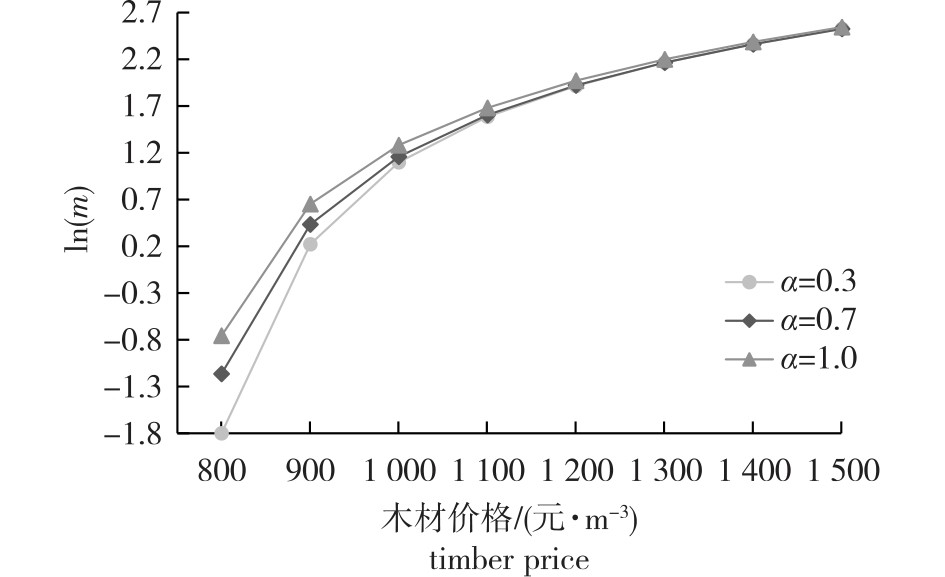

【目的】构建一种基于波动率动态变化的林业碳汇项目价值评估新方法,探究波动率非恒定条件下林业碳汇项目的价值构成及关键影响因素,为提升林业碳汇项目价值评估的准确性提供新的理论支撑和实践指引。【方法】以江西省萍乡市莲花县高天岩生态林场造林碳汇项目为实证案例,通过将碳汇收益纳入项目价值体系,构建方差常弹性(CEV)期权定价模型,并针对无风险利率、杉木价格、碳价及经营成本等关键参数,进行系统的敏感性测试以及情景模拟分析。【结果】①与传统B-S模型相比,CEV模型所计算出的期权价值更为保守;②期权价值随着弹性系数的增加呈加速增长态势;③碳汇价格波动率、木材价格和碳汇价格对期权价值具有正向驱动作用,而无风险利率和经营成本则具有负向影响,其中木材价格和无风险利率的边际效应最为显著;④在最小弹性系数条件下,各不确定因素对期权价值的影响程度显著放大。【结论】CEV模型有效地解决了传统方法因恒定波动率假设导致的“尖峰厚尾”“波动率微笑”等市场异象,更符合中国林业碳汇市场的实际波动特征。

【Objective】This research develops an innovative valuation framework incorporating volatility dynamics for forestry carbon sequestration projects. 【Method】Using the afforestation project at Gaotianyan Ecological Forest Farm in Jiangxi Province as a case study, we systematically examine the value composition mechanisms and key determinants under non-constant volatility conditions. The constant elasticity of variance (CEV) option pricing model is established by integrating carbon revenues into the valuation system, followed by comprehensive sensitivity tests and scenario analyses on critical parameters the including risk-free rate, timber price, carbon price and operational costs.【Result】(1) The CEV model yields more conservative option values compared to the traditional B-S model. (2) Option value exhibits accelerated growth with increasing elasticity coefficients. (3) Carbon price volatility, timber price and carbon price demonstrate positive effects on option value, while risk-free rate and operational costs show negative impacts, with timber price and risk-free rate being the most significant marginal factors. (4) The influence of uncertainties on option value becomes substantially magni fied under conditions of minimum elasticity coefficients.【Conclusion】The CEV model effectively resolves market anomalies like “fat tails” and “volatility smile” caused by the constant volatility assumption, better thereflecting actual market dynamics of China’s forestry carbon sector, thereby providing both theoretical foundation and practical guidance for enhancing valuation accuracy.

林业碳汇 / 新型实物期权 / 方差常弹性期权定价模型 / 常弹性系数

forestry carbon sequestration / new real option approach / constant elasticity of variance option pricing model / constant coefficient of elasticity

| [1] |

|

| [2] |

|

| [3] |

李怒云, 龚亚珍, 章升东. 林业碳汇项目的三重功能分析[J]. 世界林业研究, 2006, 19(3):1-5.

|

| [4] |

师玮, 赵思雪, 乔富伟, 等. 碳中和背景下的中国碳汇林业生产效率时空分异及影响因素研究[J]. 南京林业大学学报(自然科学版), 2025, 49(3):254-264.

|

| [5] |

曹先磊, 张颖, 石小亮, 等. 碳交易视角下森林碳汇生态补偿优化管理研究进展[J]. 资源开发与市场, 2017, 33(4):430-435.

|

| [6] |

董捷, 曾咪. 基于碳汇收益和木材收益损失的碳汇造林补偿标准研究[J]. 浙江农业学报, 2022, 34(4):790-800.

|

| [7] |

支玲, 许文强, 洪家宜, 等. 森林碳汇价值评价:三北防护林体系工程人工林案例[J]. 林业经济, 2008, 30(3):41-44.

|

| [8] |

桂芝, 彭红军, 史立刚. 碳汇价格保险下碳汇林的经营策略[J]. 南京林业大学学报(自然科学版), 2024, 48(5):267-274.

|

| [9] |

曹先磊. 碳交易机制下造林碳汇项目投资时机与投资期权价值分析[J]. 资源科学, 2020, 42(5):825-839.

|

| [10] |

徐雪漫, 宋维明. 评价林业投资的实物期权方法[J]. 林业经济问题, 2004, 24(2):115-117.

|

| [11] |

宋晓梅, 田海龙, 秦涛. 考虑碳成本与收益的森林和林地资源实物期权定价理论研究[J]. 科技管理研究, 2014, 34(16):200-204.

|

| [12] |

闫晔, 修长柏. 基于期权定价理论的草原碳汇价值评估:以内蒙古四子王旗为例[J]. 干旱区资源与环境, 2014, 28(11):31-36.

|

| [13] |

柯文岚, 李泽伟, 罗世兴. 福建省林业碳汇项目价值评估及金融产品定价:基于实物期权理论[J]. 中国国土资源经济, 2024, 37(1):48-55.

|

| [14] |

丁华, 程琴. 运用实物期权法对林业碳汇项目的价值评估[J]. 东北林业大学学报, 2020, 48(5):139-143,147.

|

| [15] |

张开玄, 王思博. 实物期权定价法在林业上市公司价值评估中的应用[J]. 林业经济问题, 2017, 37(1):87-92,111.

|

| [16] |

|

| [17] |

|

| [18] |

郭宗怀, 胡兵, 徐友才. CEV模型下支付红利的美式看跌期权的差分法[J]. 四川大学学报(自然科学版), 2018, 55(6):1162-1166.

|

| [19] |

|

| [20] |

|

| [21] |

常浩, 荣喜民, 赵慧. CEV模型下基于二次效用最大化的资产-负债管理模型[J]. 工程数学学报, 2014(1):112-124.

|

| [22] |

刘小涛, 刘海龙. CEV模型下考虑风险相关性的保险组合时间一致性投资策略[J]. 系统管理学报, 2022, 31(1):53-65.

|

| [23] |

|

| [24] |

|

| [25] |

王火根, 李晴枫, 饶涵. 碳中和背景下林业生态产品全生命周期价值核算:以湿地松为例[J]. 林业经济, 2022, 44(7):79-96.

|

| [26] |

沈月琴, 王枫, 张耀启, 等. 中国南方杉木森林碳汇供给的经济分析[J]. 林业科学, 2013, 49(9):140-147.

|

| [27] |

陈则生. 杉木人工林经济成熟龄的研究[J]. 林业经济问题, 2010, 30(1):22-26.

|

| [28] |

薛蓓蓓, 田国双. 基于碳汇木材复合经营目标的综合效益及影响因素分析[J]. 南京林业大学学报(自然科学版), 2021, 45(2):205-212.

|

| [29] |

|

| [30] |

|

| [31] |

王周绪, 姜全飞. 中国林业行业基准贴现率研究[J]. 林业经济, 2006, 28(6):39-44.

|

| [32] |

朱臻, 沈月琴, 张耀启, 等. 碳汇经营目标下的林地期望价值变化及碳供给:基于杉木裸地造林假设研究[J]. 林业科学, 2012, 48(11):112-116.

|

/

| 〈 |

|

〉 |