PDF(1728 KB)

PDF(1728 KB)

Management strategy of carbon sequestration forest under carbon sequestration price insurance

GUI Zhi, PENG Hongjun, SHI Ligang

Journal of Nanjing Forestry University (Natural Sciences Edition) ›› 2024, Vol. 48 ›› Issue (5) : 267-274.

PDF(1728 KB)

PDF(1728 KB)

PDF(1728 KB)

PDF(1728 KB)

Management strategy of carbon sequestration forest under carbon sequestration price insurance

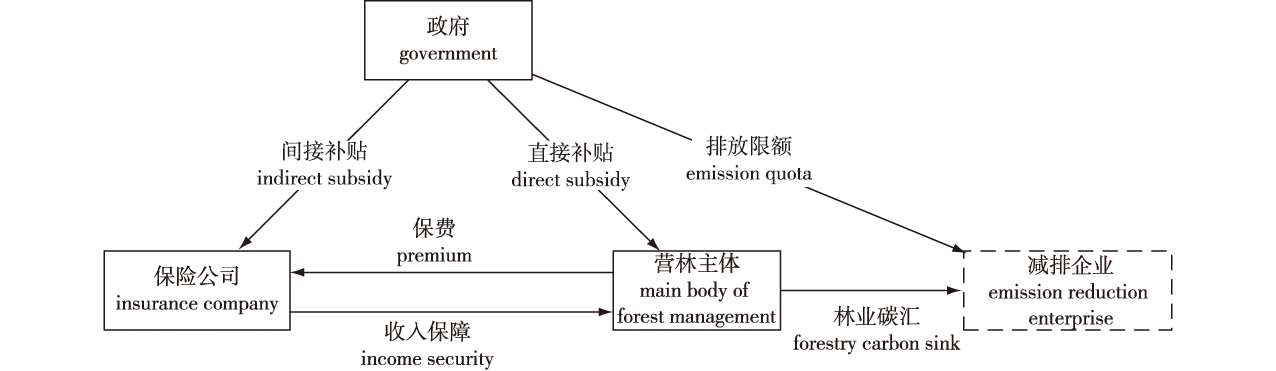

【Objective】 Under the background of a “dual carbon” objective, the optimal management strategy of carbon sink forest under carbon sink price insurance was studied with the aim of providing a reference for decision-making of carbon sink forest management.【Method】 Taking the carbon sink price insurance contract composed of forest operators and insurance companies as the research object, the conditional value at risk (CVaR) measurement criterion and Stackelberg game model were used to study the management strategy of carbon sink under carbon sink price insurance.【Result】When the target price of carbon sink in carbon sink price insurance was low, the increase of risk avoidance degree of forest operators would reduce the planting scale of carbon sink forests, the total carbon sink, and insurance cost, but would increase the carbon sink per unit area. In contrast, when the target price of carbon sink in carbon sink price insurance was high, the planting scale of carbon sink forests, the total amount of carbon sink, and the insurance cost were not affected by the risk avoidance degree of forest enterprises. The results also showed that increases in the target price of carbon sink and the subsidy rate of carbon sink price insurance could increase the planting scale and the total carbon sink but reduced the carbon sink per unit area. In addition, if the government provided the same amount of premium subsidies to forest enterprises and insurance companies respectively, government subsidies for insurance companies could promote the growth of planting scale and total carbon sink more than subsidies for forest enterprises, but the marginal efficiency of both subsidy methods was decreasing. 【Conclusion】Forest enterprises can reduce the impact of their risk avoidance behavior on carbon sequestration forest management by purchasing carbon sequestration price insurance. When forest enterprises and insurance companies agree on the target price of carbon sink in carbon sink price insurance, they should set the target price of carbon sink within a reasonable range. The government can combine subsidies to forest enterprises and insurance companies to improve the quality and supply of carbon sinks.

carbon sink price insurance / planting scale / carbon sink / government subsidy

| [1] |

侯旭华, 汤宇卉. 森林保险助推“双碳”目标实现路径研究:以湖南省为例[J]. 湖南社会科学, 2022(6):64-74.

|

| [2] |

王火根, 李晴枫, 饶涵. 碳中和背景下林业生态产品全生命周期价值核算:以湿地松为例[J]. 林业经济, 2022, 44(7):79-96.

|

| [3] |

马雯雯, 赵晟骜. 金融服务林业碳汇发展及问题研究[J]. 西南金融, 2020(6):46-55.

|

| [4] |

甘庭宇. 碳汇林业发展中的农户参与[J]. 农村经济, 2020(9):117-122.

|

| [5] |

李昌沐, 秦涛, 王姗. 森林保险保费补贴规模的影响因素分析[J]. 林产工业, 2021, 58(7):88-91.

|

| [6] |

富丽莎, 秦涛, 潘焕学, 等. 森林保险保费补贴政策林业产出激励效应评估[J]. 林业经济问题, 2021, 41(2):154-163.

|

| [7] |

徐晋涛, 易媛媛. “双碳”目标与基于自然的解决方案:森林碳汇的潜力和政策需求[J]. 农业经济问题, 2022(9):11-23.

|

| [8] |

彭红军, 徐笑, 俞小平. 林业碳汇产品价值实现路径综述[J]. 南京林业大学学报(自然科学版), 2022, 46(6):177-186.

|

| [9] |

|

| [10] |

|

| [11] |

|

| [12] |

|

| [13] |

|

| [14] |

秦涛, 李昊, 宋蕊. 林业碳汇保险模式比较、制约因素和优化策略[J]. 农村经济, 2022(3):60-66.

|

| [15] |

|

| [16] |

|

| [17] |

薛蓓蓓, 田国双. 不同碳补贴机制下杉木人工林最优轮伐期和碳汇成本分析[J]. 南京林业大学学报(自然科学版), 2022, 46(2):27-34.

|

| [18] |

|

| [19] |

|

| [20] |

夏玲, 秦涛. 我国公益林保险发展困境与运行机制优化[J]. 金融理论与实践, 2022(4):109-118.

|

| [21] |

黄宰胜, 陈治淇, 陈钦, 等. 林农碳汇林经营意愿影响因素分析:基于碳汇造林试点地区的实证检验[J]. 生态经济, 2017, 33(4):34-37,42.

|

| [22] |

罗顺兰, 胡原, 曾维忠, 等. 相对视角下森林碳汇项目农村经济福利效应[J]. 南京林业大学学报(自然科学版), 2023, 47(4):253-261.

|

| [23] |

|

| [24] |

陈伟, 顾蕾, 冯贻勇, 等. 风险态度、风险感知对农户碳汇林流转意愿的影响[J]. 浙江农林大学学报, 2021, 38(6):1270-1278.

|

| [25] |

薛蓓蓓, 田国双. 基于碳汇木材复合经营目标的综合效益及影响因素分析[J]. 南京林业大学学报(自然科学版), 2021, 45(2):205-212.

|

| [26] |

储安婷, 宁卓, 杨红强. 林业碳汇对人工林最优轮伐期的影响:以杉木和落叶松为例[J]. 南京林业大学学报(自然科学版), 2023, 47(3):225-233.

|

| [27] |

|

| [28] |

彭红军, 杨梦. 期权合约下基于CVaR的订单农业供应链协调研究[J]. 运筹与管理, 2023, 32(3):131-136.

|

/

| 〈 |

|

〉 |